Dollar Cost Averaging

The investment strategy commonly referred to as ‘dollar cost averaging’ is a regular savings plan into shares or managed funds. It manages risk, buying a small parcel of shares or units often, rather than a lump sum on one day.

What is Dollar Cost Averaging?

The investment strategy commonly referred to as ‘dollar costaveraging’ is a regular savings plan into shares or managed funds. This strategy is generally utilised to manage risk i.e. buying a small parcel of shares or units often, rather than a lump sum in a day. There is a risk that if you buy them all on one day, the price might be high at that time.

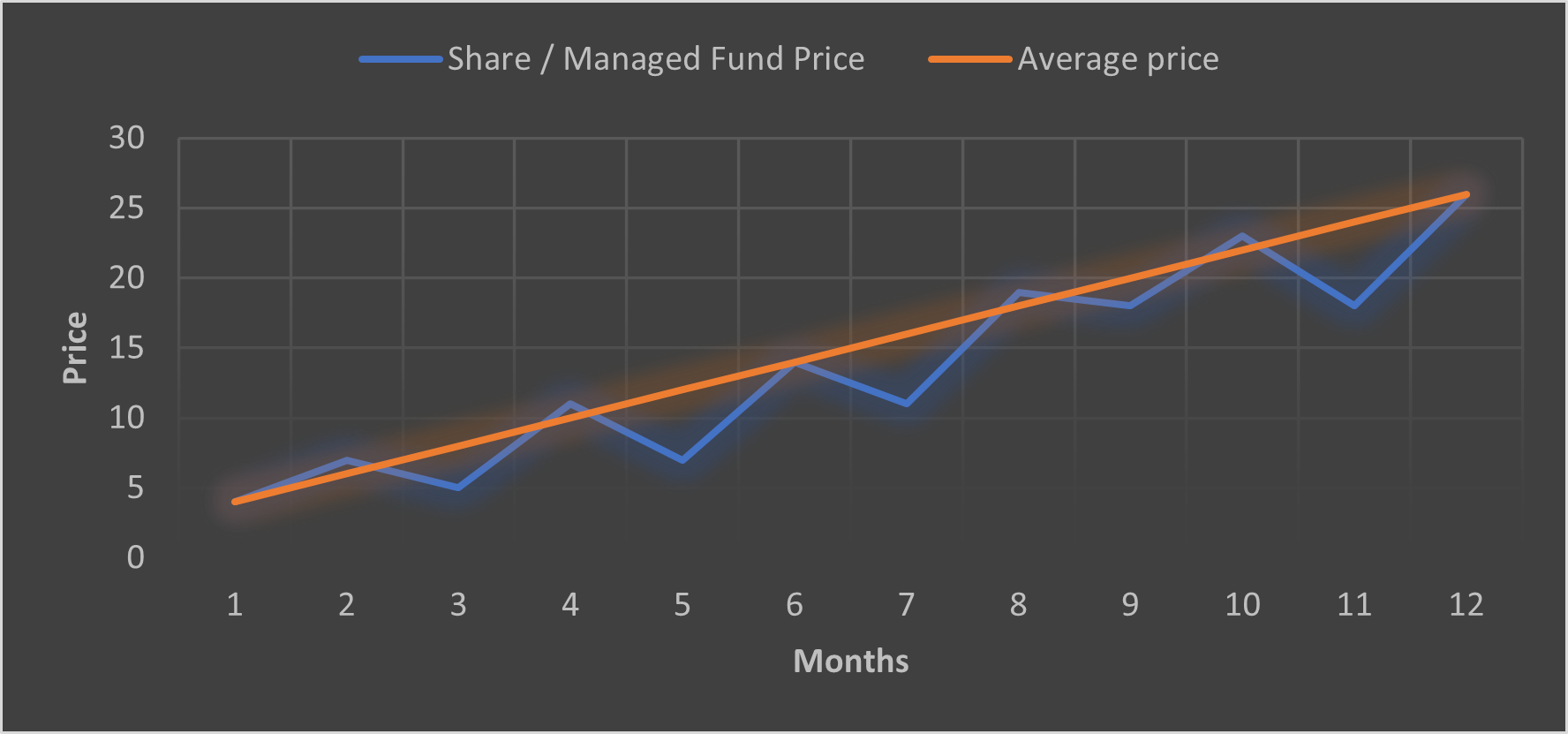

If you buy often with smaller amounts, historical performance suggests that in a volatile market, you will buy more at a low price and less at a high price. This reduces the cost of your portfolio, leaving more upside for investment returns!

How does it work?

- If you buy shares through a trading account, you can choose how many you buy if it amounts to whole shares/units.

- Some managed funds will allow a regular invest plan with as little as $1,000 to begin. The regular amount starts from around $250 per month.

- Regular investing through a platform such as a wrap account or managed discretionary account, will also allow for an automated set up to make regular investments.

What are the benefits?

- You can start your wealth creation strategy without a large initial lump sum to invest.

- Dollar cost averaging is generally most effective in a volatile market and provides smoothing of the entry price into the investment.

- The risk of investing a lump sum at a high price is reduced by the averaging of entry prices from regular investment. This reduces the cost of your portfolio, leaving more upside for investment returns!

What should I be thinking about?

- Dollar cost averaging does not eliminate all market and investment risk. Your portfolio returns will still be subject to market volatility and investment performance.

- Starting with a lower investment means that it will take longer to build an investment portfolio where further diversification can reduce some market or sector risk.

- You don't get to "pick" the market. The timing of purchases is often pre-set and therefore automated.

Important information regarding this information

This information is of a general nature. It does not consider your personal objectives, needs or situation. It does not represent legal, tax or personal advice and should not be taken as such. If it has been provided to you with a Statement of Advice (SoA), you should rely on the personal advice in the SoA.

Care has been taken to provide up to date and accurate information relating to the subject area however BR Advice Pty Ltd (ABN 30 612 056 523, AFSL 488655), Blue Rock Private Wealth Pty Ltd (ABN 95 166 927 055, AFSL 452733), and their representatives make no representation as to its accuracy or completeness.

Published: July 2025.

© Copyright 2025.