Managed Discretionary Account

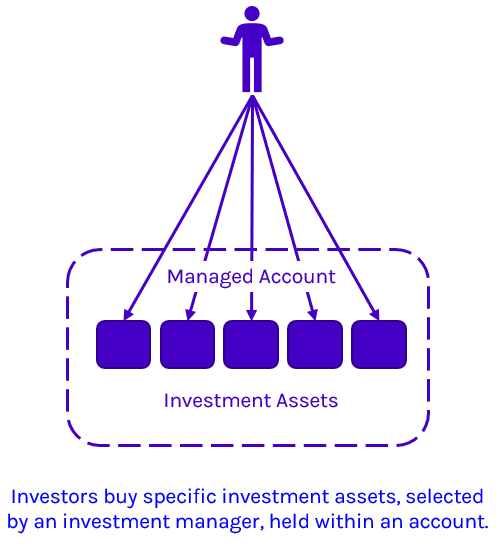

An MDA is a service that allows your portfolio to be managed and administered at the discretion of a licensed MDA Operator, through an Investment Manager.

How does it work?

An MDA is a service that allows your portfolio to be managedand administered at the discretion of a licensed MDA Operator, through an Investment Manager. Like a professionally managed fund, once the investmentstrategy and risk/return target for the portfolio is agreed by you and youradviser, investment decisions are managed on your behalf by the InvestmentManager, resulting in an underlying investment portfolio encompassing a highlevel of rigor and professional management.

You beneficially own the underlying securities and/or unitsin any investments and/or managed funds and can view the exact position ofthese investments on a daily basis. The MDA structure simply provides theinvestment flexibility, transparency, administration and control to effectivelymanage a portfolio on your behalf. By agreeing to use an MDA you are agreeingto allow a licensed MDA Operator and its agents to purchase and redeem directinvestments on your behalf. This will be done under the terms of a managedaccount contract held with the respective MDA Operator which will be in linewith your agreed investment strategy with an appropriate review and managementprogram in place with your financial adviser.

What are the benefits?

- MDAs allow the creation and management of a portfolio of stocks that align with your investment profile and personal wealth objectives.

- MDAs provide timely reporting as well as access to investment research and market insights through the online portal.

- As your portfolio is designed specifically for you, we have flexibility in managing your dividends, tax payments and capital gains.

- By granting us a dealing authorisation, we can trade, acquire and dispose of investments on your behalf to keep your portfolio aligned to your investment objectives. Corporate actions can also take place swiftly on your behalf.

- Allowing direct control over your portfolio will allow your adviser to time or stagger investment decisions in response to market conditions.

- Investing in direct shares will provide diversity to your overall investment portfolio.

- If investing in shares, Australian share dividend income is tax-effective where franking credits are provided. You have the option to reinvest your dividend income back into your shares, reducing transactions costs as well as investing for further capital growth.

- Holding shares directly provides flexibility as you can sell a selection of individual shares as needed. It also provides flexibility to manage capital gains tax on the sell down of your portfolio.

What should I be thinking about?

- MDAs allows the MDA Operator to buy and sell particular assets without your consent prior to the purchase or sale. By entering into the contract you are bound by their actions and the changes they make. It is important you understand what they are authorised to do and carefully read the disclosure documents to understand the actions that you are authorising them to perform on your behalf.

- The investment decisions made are subject to various market, currency, economic, political and business risks, and our investment decisions may not always be profitable and may at times result in losses. There is also a risk that management and investment decisions will not achieve your expectations and needs. This risk may also affect the value of your investment and the return you may receive.

- Actions taken pursuant to the MDA may trigger a capital gains tax liability or capital losses, depending on your personal tax position. You should seek advice about the tax implications that would be applicable to you.

- Actions taken are binding on your, so long as they are within the terms of the MDA contract that you entered into.

- Investing directly into shares increases your exposure to market volatility.

- Capital growth and dividend payments are not guaranteed.

- The returns on the portfolio are not guaranteed and you may experience negative returns from time to time.

- It is best to have a long-term outlook for the ownership of direct shares; this may help to smooth out the impact of market volatility on your share portfolio performance.

- MDAs charge administration fees for the operation of your account.

- Brokerage fees will be payable for the purchase of your share portfolio. Any further buys and sells within your portfolio will be subject to brokerage also.

- Diversification across companies and markets is harder to achieve when building a portfolio of direct shares. Managed funds provide more diversification at a lower level of investment.

- Capital gains tax may be payable on the sale of shares. Please seek professional tax advice before selling any shares.

Important information regarding this information

This information is of a general nature. It does not consider your personal objectives, needs or situation. It does not represent legal, tax or personal advice and should not be taken as such. If it has been provided to you with a Statement of Advice (SoA), you should rely on the personal advice in the SoA.

Care has been taken to provide up to date and accurate information relating to the subject area however BR Advice Pty Ltd (ABN 30 612 056 523, AFSL 488655), Blue Rock Private Wealth Pty Ltd (ABN 95 166 927 055, AFSL 452733), and their representatives make no representation as to its accuracy or completeness.

Published: July 2025.

© Copyright 2025.