A common question many Australians have is how much money they need to retire if they want to keep doing things they enjoy like travel, going out to nice dinners, and playing club sports.

To determine when you’re ready to retire, it’s useful to understand exactly how retirement looks for you. It may also be worth ignoring the average super balance at retirement, because everyone’s needs and lifestyles differ. In this article, our investment experts give their insights on when your super is sufficient for retirement.

Retirement Income and Expenses

Your superannuation needs to last you your entire retirement, but it can be difficult to predict how much cash you’ll need given there are so many variables. Will you work part time in retirement? Are you eligible for the part pension? If you’re not able to concessionally contribute, then another method of boosting your super is increasing your exposure to equities.

Equities are companies or funds made up of stocks and earn a strong return via income and appreciate as companies continue to generate higher profits each year. Fixed interest provides you the comfort of regular income however your investable funds typically don't grow.

Understand Your Time Horizon

Next, you’ll need to consider your time horizon, which is how long you have to reach your investment goals. Most people adjust their strategies and horizons as time passes.

Clients we help who are approaching retirement often seek a timeline on when retiring might make the most sense. Retired clients typically wish to preserve capital and generate strong income to facilitate their day-to-day lifestyle.

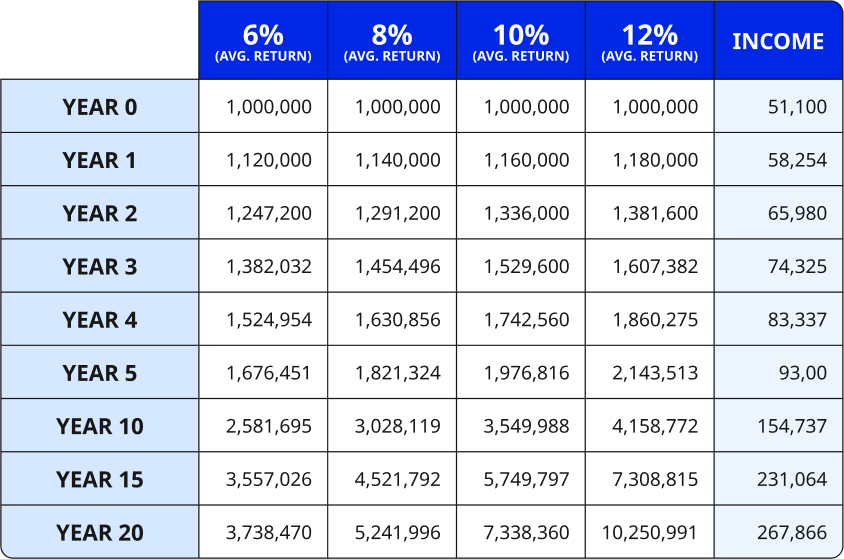

Below is an table that describes the effects of compounding interest if a $1,000,000 superannuation portfolio earnt an average return of 6%, 8%, 10% or 12% for the next 20 years (assuming that the client is 50 years old currently).

Forecast Portfolio Value Estimates ($):

*Note these calculations do not include tax considerations and we do not guarantee these results. This is only an indication of the potential future value of your portfolio through the power of compounding and continuous contribution.

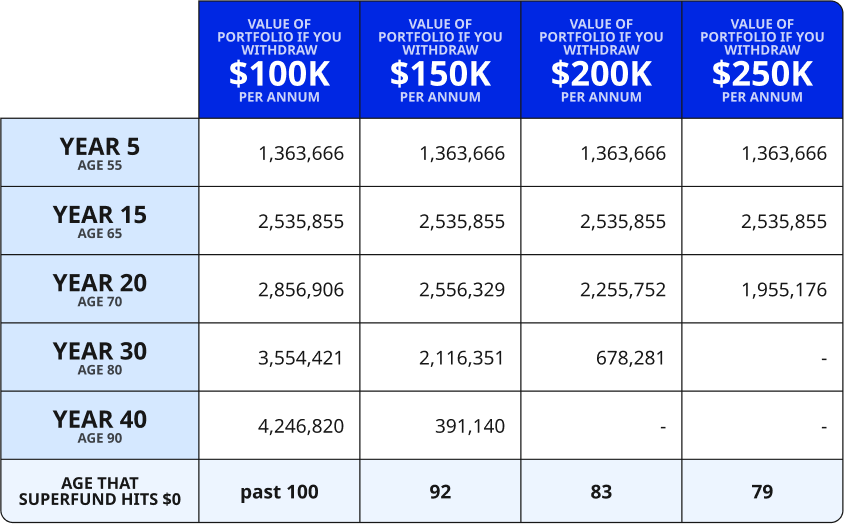

Balanced Superannuation Portfolio Predictions

The client is age 50 and has $1,000,000 in superannuation with a balanced portfolio of 60% equities and 40% fixed income. Below are the portfolio values (in $) across 40 years if the client were to take out $100,000 or $150,000 or $200,000 or $250,000.

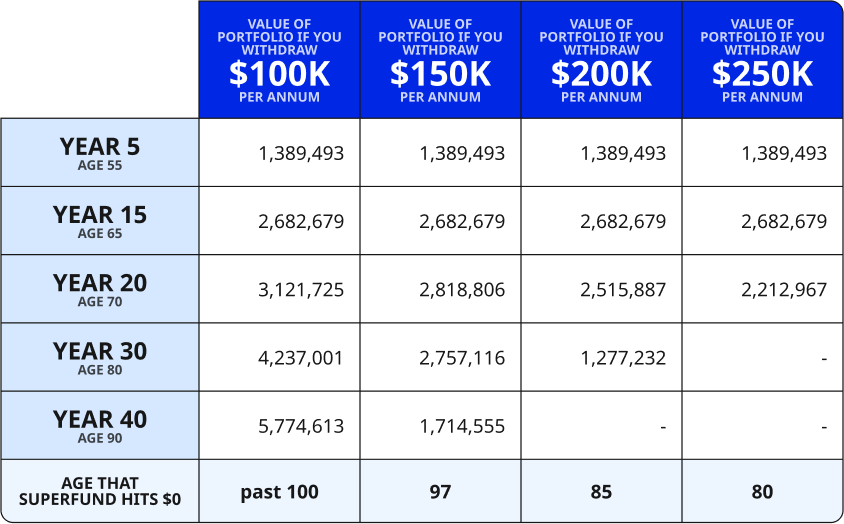

Growth Superannuation Portfolio Predictions

The client is age 50 and has $1,000,000 in superannuation with a growth portfolio of 70% equities and 30% fixed income. Below are the portfolio values (in $) across 40 years if the client were to take out $100,000 or $150,000 or $200,000 or $250,000.

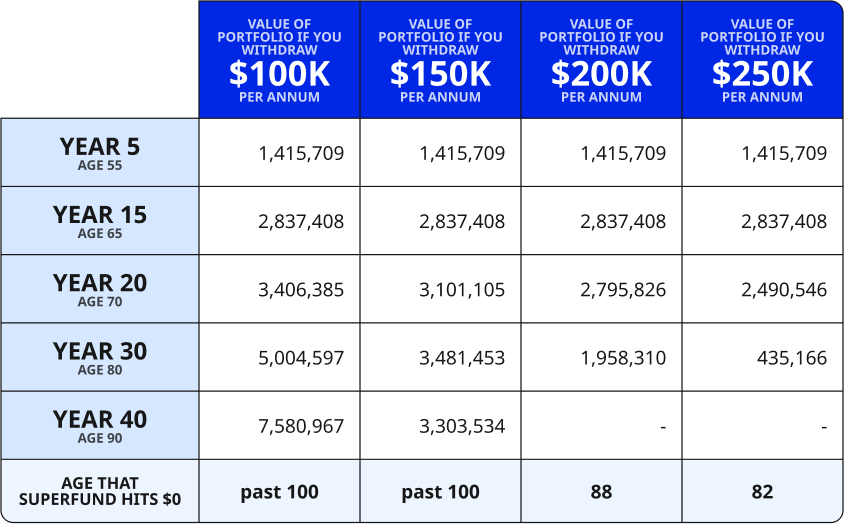

High Growth Superannuation Portfolio Predictions

The client is age 50 and has $1,000,000 in superannuation with a high growth portfolio of 80% equities and 20% fixed income. Below are the portfolio values (in $) across 40 years if the client were to take out $100,000 or $150,000 or $200,000 or $250,000.

*Note that this takes into consideration 3% inflation of goods and prices

**note that $100k would be less than the minimum superannuation withdrawals in most of the above cases.

The above exhibits assume that you do not access your superannuation until you are 65. You can see that the larger the portion of your portfolio allocated to growth, the longer your superannuation will last you.

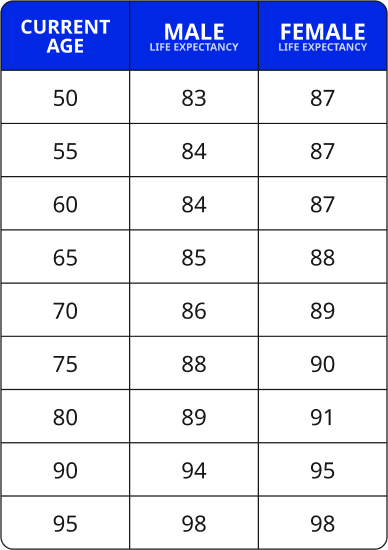

Life Expectancy Considerations

Thanks to better eating, exercise habits and medical advances, Australians are living longer. For example, women who are 65 are expected to live to 87.8 years old and men who are 65 are estimated to live to 85.2 years old.

Talk to a Financial Advisor for Retirement Success

Diversifying your portfolio can help secure strong, long-term returns to fund the retirement you desire. To ensure you're on the right path, it's essential to seek expert advice tailored to your unique financial situation. Here's what that looks like at BlueRock Wealth.

First Meeting – Identify Objectives

We explore specific goals: maximising income, preserving capital, and growing assets with long-term returns. We structure portfolios to potentially provide fully franked dividends, offering tax credits during the pension phase.

Secondary Meeting – Asset Allocation Strategy

After identifying objectives, we develop a strategy. Australian shares have yielded about 9% over 30 years, offering franking credits to boost income. Credit funds with current interest rates yield 7-10% annually, usually paid monthly. Diversification options include US and European firms like Microsoft, Apple, and Sanofi, known for strong profits.

Ready to take control of your financial future? Talk to our financial advisors for retirement success and gain the clarity needed to make your retirement savings work for you.

Disclaimer: The content is intended as general information only and should not be considered as advice on any matter and should not be relied upon as such. This has been prepared without taking into account any individual objectives, financial situation or needs. You should therefore consider the appropriateness of the information in regard to these factors before acting or seek advice before making any financial decisions. Blue Rock Investments (Melb) Pty Ltd is the holder of an Australian Financial Services Licence (AFSL No: 335588).