Whether you're nearing the end of your career or proactively planning for retirement, our investment insights are tailored to help you make the most of your nest egg. From Australian equities and high-growth funds to international equities and fixed income options, these assets could bolster your retirement savings and help secure your financial future.

Asset Allocation Strategies in Retirement

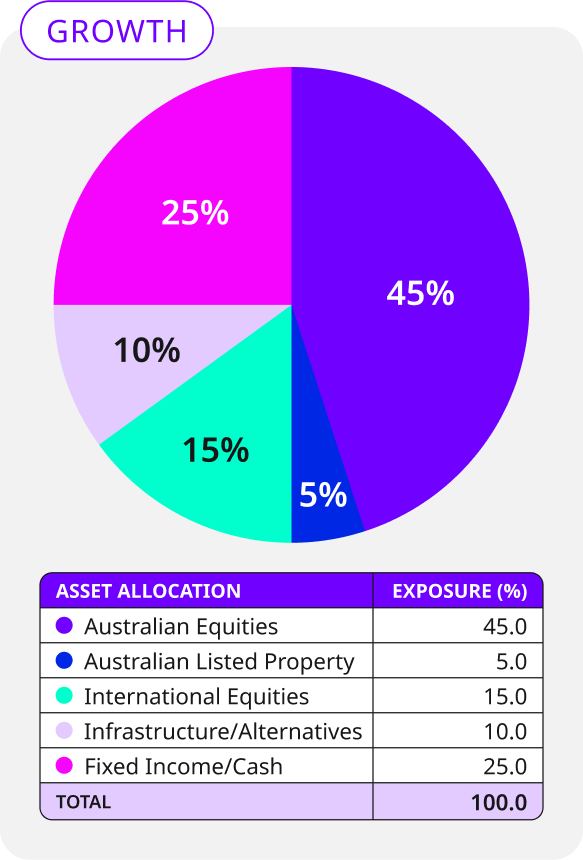

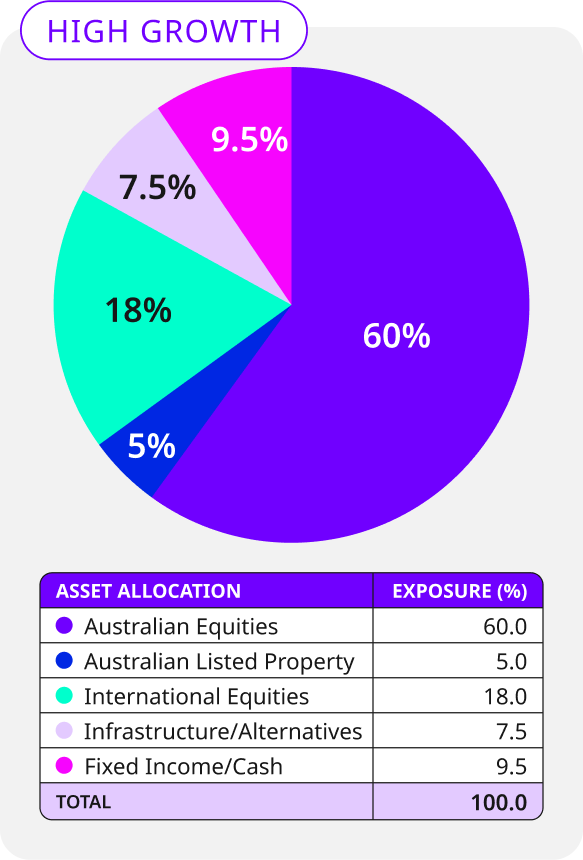

Below are some images of the asset allocation that we often recommend for retail clients depending on their risk profile.

1. Balanced

This suits investors with a minimum five-year time-frame. This portfolio also suits investors who desire a modest level of capital stability but are willing to accept moderate investment value volatility in return for commensurate potential investment performance.

2. Growth

This suits investors with a minimum seven-year time-frame or those willing to accept higher levels of investment value volatility compared to more defensive options in return for higher potential investment performance.

3. High Growth

This suits investors with a minimum nine-year time-frame or those willing to accept high levels of investment value volatility in return for high potential investment performance.

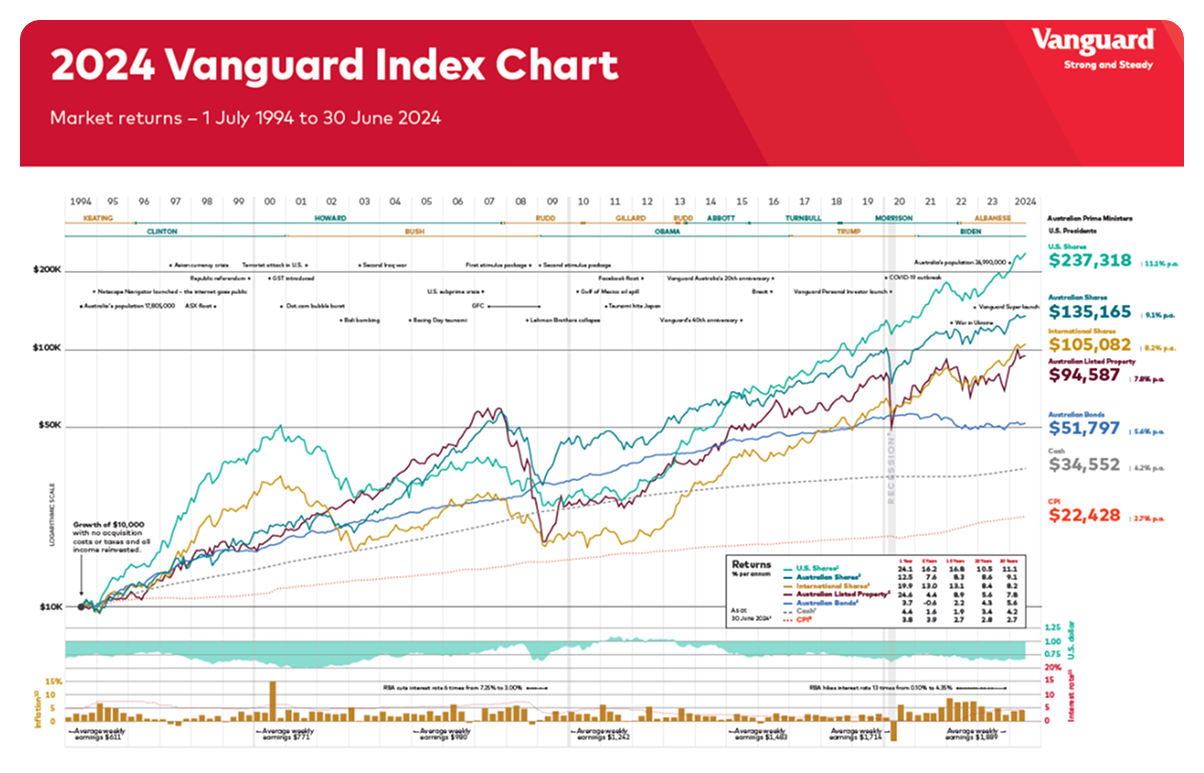

We believe that asset allocation is the single greatest determinant of portfolio returns and the likelihood of being able to afford the retirement you want. At its core asset allocation is what you decide to invest in. For most investors, this means equities, fixed interest or in rare cases cash.

Australian Equities for Retirement

- Blue chip shares such as CBA, Transurban, Wesfarmers and Macquarie

Private Equity for Retirement

Tea Tree Opportunity Trust invests in North Adelaide's upcoming Tea Tree Westfield Shopping Centre, set to be South Australia's second largest. Featuring anchor tenants like Myer and Woolworths, it starts with a 9.25% yield and aims for a 15%+ net IRR annually. With a 5-year term and liquidity options, it aligns with Scentre Group and Barrenjoey staff investments. Clients also engage with the pharmacy sector and Redcape's pub and gaming ventures, yielding about 6.5%.

High Growth Funds for Retirement

- OC Dynamic Equity Fund (unlisted) targets quality small to mid-cap Australian companies with sustainable models and strong fundamentals. It offers 11.2% pa over 10 years, diversifying exposure beyond large-cap funds' banks and resource stocks.

- OC Premium Small Company (unlisted) seeks long-term returns from small to mid-cap Australian companies with high-growth potential. It provides 9.5% pa over 10 years, balancing large-cap funds' typical exposure.

- Ophir High Conviction Fund (OPH) focuses on small/mid-cap stocks through a high conviction ETF, holding 15-30 stocks outside the top 50. It has a proven track record, outperforming the index, delivering 8.5% pa over 5 years.

International Equities for Retirement

- iShares Global Financials ETF (IXG) tracks global financial sector equities, offering exposure to banks and insurance firms with top holdings in Berkshire Hathaway, JPMorgan, VISA, and Mastercard, delivering an 8.3% pa over 10 years.

- VanEck MSCI International Quality (AUD Hedged) ETF (QHAL) invests in developed market companies outside Australia, hedged to AUD, featuring Apple and Microsoft. It achieves a 12.6% pa return over 5 years.

- VanEck MSCI International Small Companies Quality Hedged ETF (QHSM) targets 150 quality small-cap securities in developed markets, showing strong long-term performance. Its unhedged counterpart, QUAL, posted an 18.2% return in 1 year.

- iShares Europe ETF CDI (IEU) tracks the MSCI World ex Australia Quality Index, focusing on high quality growth stocks and providing an 8.0% pa return over 5 years.

Fixed Income for Retirement

- KKR Credit Income Fund (KKC) is a listed investment trust that lends to the international corporate market. This fund has delivered a 5.1% pa 5-year return however this return forward looking sits at more around 8% with more normalised rates.

- Metrics Masters Income Trust (MXT) is an investment trust listed on the ASX that provides investors with direct exposure to the Australian corporate loan market. The portfolio is diversified across borrowers, industries, credit structure and loan products. This fund has delivered a 6.7% pa 5-year return.

- Vaneck Global Listed Private Credit (Hedged) ETF (LEND) provides exposure to some of the world’s largest listed companies involved in private credit. LEND owns companies such as Blackrock, Ares Capital, Goldman Sachs and Bain Capital. Over the last 12 months, LEND yielded 9.94% and is currently trading on a low earnings ratio. This fund is relatively new and has delivered a 15.14% return across its first year.

Talk to a Financial Advisor for Retirement Success

Whether you're looking to diversify your portfolio or focus on high-growth opportunities, our team at BlueRock Wealth is here to provide expert guidance every step of the way. Contact us today to start planning the retirement you deserve.

Disclaimer: The content is intended as general information only and should not be considered as advice on any matter and should not be relied upon as such. This has been prepared without taking into account any individual objectives, financial situation or needs. You should therefore consider the appropriateness of the information in regard to these factors before acting or seek advice before making any financial decisions. Blue Rock Investments (Melb) Pty Ltd is the holder of an Australian Financial Services Licence (AFSL No: 335588).